D365 Bitesize Content: Consolidating financial data in Business Central

Find out how consolidating financial data in Business Central can help your business in this series of Dynamics 365 Bitesize Content.

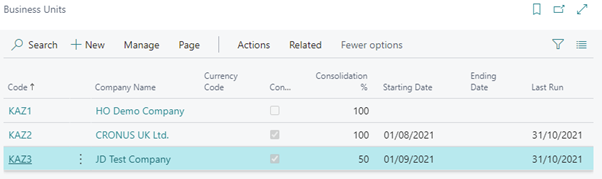

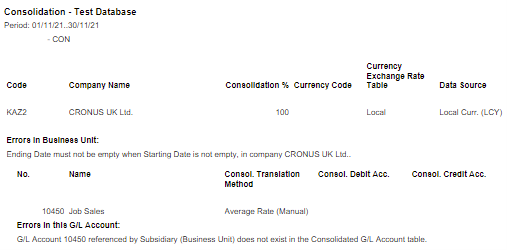

Some organizations use Business Central in multiple business units or legal entities. Others use Business Central in subsidiaries that must report into parent organizations. In both cases, the accountants use built-in tools to help when consolidating financial data in Business Central. You can consolidate the general ledger entries of two or more separate companies(subsidiaries) into a consolidated company. Each individual company involved in a consolidation is called a business unit. The combined company is called the consolidated company. You can import data into the consolidated company from other companies in the same Business Central tenant, from tenants, or from files. You can consolidate

- Across companies that have different charts of accounts.

- Companies that use different fiscal years and different currencies.

- Either the full amount or a percentage of a company's financial information.

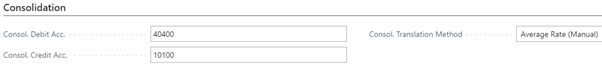

- Using different currency exchange rates in individual G/L accounts.

- Companies in other accounting and business management programs.

Features in Business Central

- Easy management of your Business Units

- Define consolidation posting accounts and translation methods per G/L Account

- Test your database to remove errors

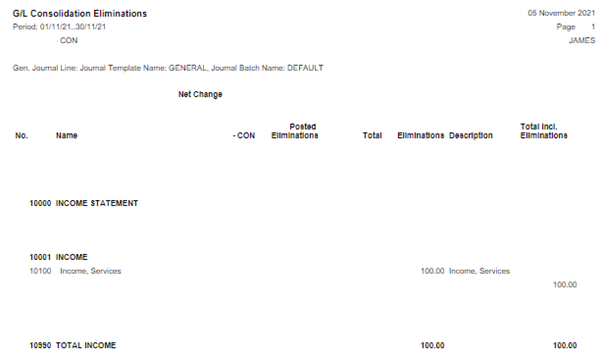

- G/L Eliminations (Tentative Trial Balance) report to simulate the consequences of eliminating entries

Advantages of consolidating financial data in Business Central

Customers who use the Company Consolidation will gain various benefits:

- Depth of data – You can create consolidated reports that bring together actual and budget data at both the account level and the dimension level.

- Dynamic consolidations – Consolidations can be processed multiple times.

- Audit capabilities – Dimensions and accounts are maintained for analysis and audit, and balances are created by date.

- Currency translation – You can set up the account ranges and rates to translate from the accounting currency of the source company to the accounting currency of the consolidation company.

- Process eliminations in a consolidated or elimination company – You can process and post eliminations as a single process during consolidation.

Did you find this content useful and want to access more Bitesize Content? Read about

- Intercompany Transactions

- Purchase Invoice Automation with Continia

- Multi-Currency in Business Central

- Expense Management

For more information on Dynamics 365 Business Central, simply get in touch or view our How To Guides.